Category: Blog

-

Truck Driver Recruiting in 2026: Modern Recruiting...

Continue ReadingTruck Driver Recruiting in 2026: Modern Recruiting Strategies

Truck driver recruiting in 2026: practical, modern strategies focused on speed, automation, and follow-up. Discover how modern recruiting strategies are transforming the trucking industry amid labor shortages and changing driver expectations.

- Introduction

- The Death of ‘Post and Pray’ Recruiting

- Understanding Today’s CDL Driver Market

- The Foundations of Modern Recruiting (2024–2026)

- Digital Tools and Automation as Catalysts

- Social Recruiting and Employer Branding

- Tapping Passive Candidates

- Metrics That Matter in 2026

- The Road Ahead: Preparing for Recruiting in 2026

- Conclusion

Introduction

The trucking industry is undergoing fundamental changes, and the traditional recruiting tactic known as “Post and Pray”—placing job ads and waiting for applications—no longer meets the demands of the evolving driver labor market. As seasoned drivers age out and fewer new entrants fill the gap, carriers relying on passive recruitment strategies are struggling to maintain operational capacity.

Several macroeconomic and regulatory shifts are reshaping the landscape. Persistent labor shortages, inflationary pressures affecting wage expectations, and tighter hours-of-service regulations are altering both the supply and demand for drivers. Additionally, fluctuations in freight volumes and high turnover rates compound the challenge of finding and keeping qualified talent.

In response, companies are turning to modern recruiting strategies that prioritize targeted outreach, data-driven campaigns, and streamlined technology tools. These approaches are defining how successful fleets will attract and retain drivers in the U.S. trucking industry by 2026.

The Death of ‘Post and Pray’ Recruiting

Definition and History

The ‘Post and Pray’ method is a traditional recruiting strategy where employers post job openings on job boards and then wait passively for applicants to respond. This approach was once considered standard in the trucking industry, especially before the digital age reshaped job-seeking behavior. In earlier decades, this method yielded predictable results because the labor market was less saturated and most drivers relied on classified ads or early online boards for job hunting. However, the once-effective method has lost traction due to shifting technologies and market dynamics.

Key Reasons Why It No Longer Works

- Low Response Rates

Modern data shows that ‘Post and Pray’ strategies are increasingly ineffective. As of Q4 2024, job board conversion rates for truck driver postings have dipped below 2% on average. That means fewer than 2 out of every 100 visitors to a job post actually apply, highlighting the inefficiency of relying solely on general job boards for recruitment.

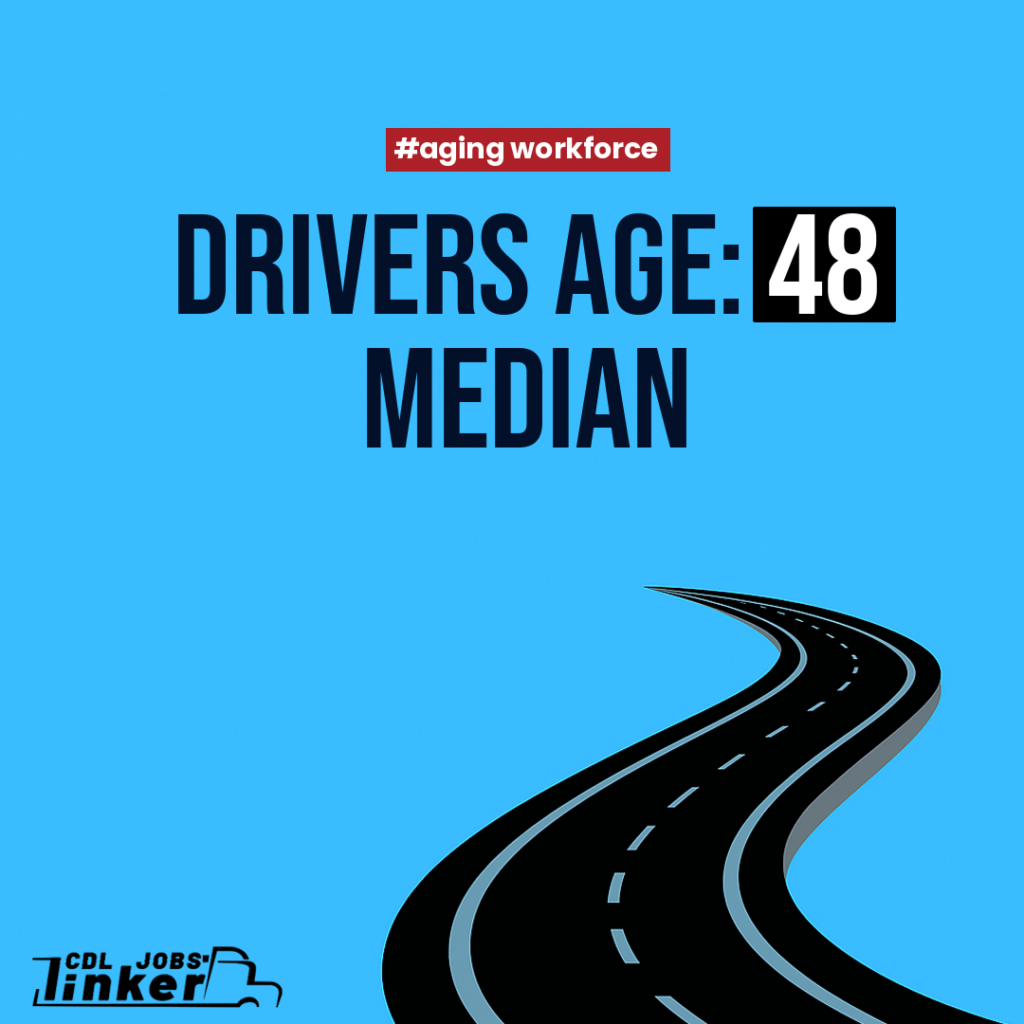

- Driver Demographics

The current driver workforce skews older, with over 57% of CDL holders now over age 45. This demographic is generally less active on digital job boards and less likely to interact with mobile or online-only recruitment channels, further diminishing response rates when using ‘Post and Pray’ strategies.

- Competition Saturation

A large number of trucking carriers are using the same job posting platforms. The top five job sites receive the majority of listings, contributing to increased saturation and reduced post visibility. As more companies compete for limited attention in the same spaces, individual job listings struggle to stand out, making passive recruitment even less viable.

Understanding Today’s CDL Driver Market

Labor Supply and Demand Imbalance

The commercial driving industry is experiencing a significant labor imbalance. In 2024, the U.S. faces a shortage of approximately 78,000 commercial drivers, and this gap is projected to grow beyond 84,000 by 2025. This persistent shortage comes despite consistent freight demand and economic uncertainty, forcing transportation companies to compete more aggressively for qualified drivers. Recruiting teams, in particular, are under increased pressure to fill open roles quickly and efficiently.

Evolving Candidate Expectations

As the demand for CDL drivers rises, so do their expectations during the recruitment process. A growing number—43% of drivers—now anticipate real-time communication when applying for positions. Moreover, the application experience itself has evolved: in 2024, over 67% of driver applications were submitted via smartphones, emphasizing the importance of a mobile-first approach. Failing to meet these expectations can result in lost candidates in an already competitive labor market.

The Foundations of Modern Recruiting (2024–2026)

Data-Driven Targeting

Automation reduced applicant ghosting by 31% in truck driver recruitment communications. Recruiters increasingly rely on data to refine and optimize their targeting strategies. Programmatic advertising has become a cornerstone of recruitment campaigns, automatically placing job ads in front of high-intent candidates. In 2024, organizations using programmatic ads saw a 21% year-over-year improvement in cost per lead, reflecting gains in both efficiency and reach.

Predictive analytics is also playing a greater role in identifying which applicants are more likely to advance through the hiring funnel. By analyzing historical candidate data and behavior patterns, recruiters can better allocate time and resources to high-conversion prospects.

Recruitment Marketing Funnel Optimization

To maximize candidate engagement from initial contact through to hire, companies are mapping each touchpoint in the recruitment funnel. This allows recruiters to identify drop-off points and optimize user experience along the way.

A/B testing is widely deployed to improve results. Recruiters test ad formats, landing pages, and pre-screening tools to determine what yields the highest engagement and conversions. Meanwhile, nurturing campaigns—such as email follow-ups and personalized content—are helping keep applicants engaged. These strategies led to a 28% increase in pipeline retention in 2024, validating the impact of continuous engagement throughout the hiring journey.

Digital Tools and Automation as Catalysts

CRM and ATS Integration

The integration of Customer Relationship Management (CRM) systems with Applicant Tracking Systems (ATS) is streamlining the hiring process across the transportation industry. As of early 2025, 81% of large fleets have adopted some form of integrated CRM/ATS platform for greater hiring efficiency. These platforms help unify communication, resume parsing, and status tracking, making the recruitment pipeline more manageable.

One major benefit of integration is the automation of routine communication. By automating applicant follow-ups, companies have seen a 31% reduction in ghosting, helping recruiters maintain contact and momentum with potential hires.

Chatbots, AI Screening, and Real-Time Engagement

Artificial intelligence tools such as chatbots and automated screeners are increasingly being used to expedite applicant evaluation. AI virtual assistants now process applications up to four times faster than traditional manual methods, allowing recruiters to focus their attention on qualified candidates sooner.

In addition, real-time communication tools like live chat are proving effective for increasing candidate engagement. Carriers using live chat solutions report a 19% rise in completed applications, demonstrating the value of immediate, accessible contact during the application process.

Social Recruiting and Employer Branding

Social Channels Driving Reach

Social media continues to be a powerful tool for reaching and engaging potential drivers. In 2024, 54% of drivers report discovering job opportunities through social media platforms, with Facebook and YouTube being the most effective channels. These platforms offer carriers a direct line to a large, active user base, allowing for real-time communication and content distribution tailored to prospective applicants.

Employer Value Proposition (EVP)

A compelling Employer Value Proposition plays a central role in social recruiting success. Carriers that clearly communicate driver-centric messaging—emphasizing benefits, transparent compensation, and a supportive work culture—see a 32% reduction in cost-per-hire. Authentic content, such as video testimonials from current drivers, also significantly boosts candidate engagement. These videos generate engagement rates twice as high as other content formats, helping to humanize the brand and build trust with potential recruits.

Tapping Passive Candidates

Who Are Passive CDL Candidates?

Over 57% of CDL holders are now 45+, pushing carriers to modernize recruiting. Passive CDL candidates are licensed commercial drivers who are currently employed or not actively searching for a new position but may consider switching for the right opportunity. Unlike active job seekers, passive candidates are less likely to browse job boards or submit applications. However, they form a significant portion of the CDL labor market. As of late 2024, approximately 48% of licensed CDL drivers fall into this passive category.

Strategies to Engage

To connect with passive CDL candidates, companies must adopt targeted and persistent outreach strategies:

- Retargeting Ads: Using data on browsing behavior, employers can serve relevant job ads to drivers who have previously visited trucking-related websites or platforms.

- Email Drip Campaigns and SMS Outreach: Create automated sequences of messages that highlight job benefits, pay scales, and company culture. Text messages can provide quick updates or short pitches that prompt further interest.

- Referral Network Optimization: Encourage current drivers and staff to refer friends or former colleagues. This organic method often reaches those not actively job hunting.

- Geofencing: Deploy mobile job ads around high-traffic areas like truck stops, rest areas, and cargo terminals. These location-based ads can capture the attention of drivers while they’re on the road.

Combining these tactics allows employers to stay visible and relevant to passive drivers, increasing the chance of eventual engagement.

Metrics That Matter in 2026

Redefining Success in Driver Recruiting

As the driver recruiting landscape evolves, so do the metrics that define success. In 2026, companies are focusing on key performance indicators (KPIs) that directly reflect operational efficiency and hiring effectiveness.

- Time to Qualified Lead: is now measured from the launch of a campaign to the point when a candidate passes pre-screening. This shift emphasizes the importance of responsiveness and targeting in top-of-funnel activities.

- Cost per Hire (CPH): remains a critical benchmark. In Q3 2024, the top 25% of performers reported hiring costs under $1,500 per driver. This figure continues to serve as a north star for organizations aiming to optimize spend.

- Applicant-to-Orientation Rate: is gaining traction as a core KPI. It reflects how well initial screening processes translate into actual driver onboarding. Efficient pre-screening protocols significantly improve this rate, turning more applicants into hires without wasting resources.

Continuous Improvement Cycles

Successful recruiting teams are moving to quarterly benchmarking of their funnel KPIs. This cadence allows for faster identification of bottlenecks and more agile strategy adjustments.

Additionally, there is a notable shift toward digital oversight. Real-time dashboards and automated reporting tools have seen a 39% year-over-year growth in adoption. These tools enable teams to monitor performance as it happens, fostering a culture of continuous improvement and accountability.

The Road Ahead: Preparing for Recruiting in 2026

Adapting to AI and Machine Learning

As 2026 approaches, AI and machine learning (ML) are reshaping how organizations attract and engage talent. One key trend is the surge in AI-generated job ad personalization. With improved natural language processing and deeper user behavior analysis, recruitment platforms are delivering hyper-targeted job listings that reflect individual preferences, qualifications, and even location-based incentives.

In addition to personalization, AI systems are enabling real-time optimization of recruitment spend across platforms. Employers can automatically shift budget between job boards, social media ads, and sourcing tools based on real-time performance data, ensuring greater return on investment and better candidate engagement.

Retention and Recruitment Converge

The lines between hiring and employee retention are blurring. In 2025, 23% of HR teams reported merging their talent acquisition and retention efforts into unified strategies. This shift, often referred to as recruiting-realignment, reflects a growing need to maintain a consistent employee experience from candidate to post-hire.

Organizations are also leveraging career path visibility as a recruitment advantage. By clearly outlining growth opportunities and timelines from the outset, employers can attract candidates who are focused on long-term development. This strategy not only increases offer acceptance rates but also supports retention by aligning new hires’ expectations with internal mobility opportunities.

Conclusion

Programmatic advertising improved cost per lead by 21% Success in 2026 will belong to carriers who recruit with intention, data, and speed. The most competitive organizations will be those that recognize recruiting is no longer a numbers game—it’s a strategy. They will leverage detailed data and analytics to identify the right prospects, tailor communications, and track performance in real-time.

As the industry shifts, the age of ‘Spray and Pray’ is over. Mass outreach without targeting or follow-through won’t yield results. The future of recruiting is personalized, persistent, and strategically precise. Those who adapt will gain access to higher quality candidates and a more robust workforce to drive sustainable growth.

Frequently Asked Questions

What are the highest paying trucking jobs in 2025?

The highest paying trucking jobs in 2025 will include specialized hauling positions, long-haul trucking, and roles with regional carriers offering competitive bonuses.

How is technology changing trucking?

Technology is enhancing the trucking industry through automated recruitment processes, AI-driven tools for candidate engagement, and data analytics for performance tracking.

-

CDL Driver Pay in 2026: Key Compensation...

Continue ReadingCDL Driver Pay in 2026: Key Compensation Changes Explained

Median CDL driver pay reached $64,200 in 2024, up 5.1% from 2023. Explore strategies for CDL drivers to secure better pay amidst industry changes and labor shortages.

- Introduction

- The 2024–2025 Economic Landscape for CDL Drivers

- Key Components of a Competitive Compensation Package

- Strategies for CDL Drivers to Negotiate Better Compensation

- The Role of Unions, Advocacy Groups, and Legislation

- Carrier Strategies to Retain Drivers through Compensation

- Emerging Trends and the Future of Driver Compensation

- Resources and Tools for Drivers

- Conclusion

Introduction

The U.S. commercial trucking industry plays a critical role in the national supply chain, moving over 70% of all freight across the country. At the core of this system are CDL (Commercial Driver’s License) holders—professional drivers responsible for transporting goods safely and efficiently. Without them, the flow of essential products and materials would slow dramatically, affecting industries from agriculture to retail.

In recent years, the trucking industry has experienced significant changes. Economic trends such as inflation, supply chain bottlenecks, and evolving consumer demands have directly influenced driver compensation, leading to fluctuations in wages and benefits. While some carriers have increased pay in response to market pressures, not all drivers are receiving compensation that reflects their value and workload.

Adding to the complexity is a persistent labor shortage. The American Trucking Associations (ATA) projects the U.S. truck driver shortfall to exceed 80,000 in 2024, a continuation of a growing deficit in qualified CDL holders (ATA). At the same time, demand for freight transport remains high, creating favorable conditions for drivers to negotiate better terms.

This article aims to empower CDL drivers with practical strategies to advocate for improved pay and benefits. By understanding the current market dynamics and leveraging demand, drivers can take steps toward securing fair compensation in a competitive and essential industry.

The 2024–2025 Economic Landscape for CDL Drivers

Industry Demand and Labor Shortage

The demand for CDL drivers continues to rise in 2024 and is expected to remain strong into 2025, driven by growth in e-commerce, retail, and construction sectors. These industries have increased their freight movement needs, putting more pressure on the trucking workforce.

According to the Bureau of Labor Statistics, demand for long-haul drivers has surged by 14% year-over-year (BLS). Despite this strong demand, the industry faces a persistent labor shortage. Nearly 30% of trucking companies report ongoing difficulties in recruiting and retaining drivers, creating a chronic shortage across the board (FTR). This gap between demand and available labor has made CDL drivers an increasingly valuable asset in the logistics chain.

Inflation and Wage Growth

While driver demand is climbing, wage growth has not fully kept pace with inflation and rising operational expenses. In 2023, the median annual wage for heavy and tractor-trailer drivers reached $53,090—representing only a modest increase from 2022 levels (BLS). When adjusted for inflation, the real income of drivers has slightly declined, eroding the purchasing power of their earnings.

The combination of rising costs and relatively stagnant wages presents a challenge for both drivers and trucking companies. As expenses such as fuel and insurance increase, some drivers are seeing less take-home pay in real terms, even if their nominal wages have gone up.

Key Components of a Competitive Compensation Package

Beyond the Base Salary

CDL-A driver vacancy rates exceeded 8.5%—a 15-year peak as of Q1 2024. Driver pay structures in the trucking industry vary widely, extending far beyond base salary. Two primary models dominate: hourly pay and cents-per-mile (CPM) compensation. Hourly pay can offer greater income stability and is more common in local or regional routes. On the other hand, CPM pay is standard for long-haul and over-the-road (OTR) positions, where drivers are compensated based on miles driven, incentivizing productivity.

In addition to base pay, many carriers offer performance and safety bonuses. These incentives reward drivers for maintaining clean safety records, meeting delivery schedules, and achieving fuel efficiency targets. Such bonuses not only enhance earnings but also promote company-wide standards of excellence.

Per diem pay is another critical, often-overlooked component. This benefit provides tax-advantaged compensation to long-haul drivers to cover meals and incidental expenses on the road. It can lead to substantial annual tax savings, making it an attractive feature of a total compensation package.

Retirement, Health, and Insurance Benefits

Health insurance remains a vital, yet inconsistently offered, benefit among trucking employers. According to the OOIDA Foundation, only 58% of drivers report being offered employer-sponsored healthcare. The lack of widespread access to medical coverage remains a significant concern for driver retention and well-being.

Retirement planning support is even less common. Data from the FMCSA indicates that fewer than half of carriers offer 401(k) matching or pension programs. This gap poses long-term financial challenges for drivers and highlights an area of opportunity for companies aiming to attract and retain top talent.

Time Off and Work-Life Balance

Paid time off (PTO) is becoming a more prominent feature of compensation packages, especially amid wider discussions around work-life balance. While PTO allowances in the trucking industry typically lag behind other sectors, more companies are beginning to improve their offerings to stay competitive.

The importance of home time has emerged as a critical retention factor. Drivers increasingly prioritize time with family and consistency in scheduling over incremental increases in pay. However, access to predictable schedules remains limited, especially in OTR operations, where delivery windows and freight volumes often dictate work hours.

Improving scheduling transparency, home time, and PTO availability are crucial steps in building compensation packages that address driver demands and promote long-term employment relationships.

Strategies for CDL Drivers to Negotiate Better Compensation

Know Your Value

Before sitting down at any negotiation table, CDL drivers should have a clear understanding of their market worth. One effective way to do this is by utilizing wage comparison tools and reviewing industry benchmarks. According to Truckload Indexes, driver wages have increased by 8.6% since 2022 in certain regions. This data can serve as a powerful talking point for negotiating higher pay.

Drivers should also highlight skill-based qualifications that set them apart. Clean driving records, years of experience, and special endorsements—such as HAZMAT, doubles-triples, or tanker—can justify higher compensation. These differentiators reinforce your value and provide factual support during negotiations.

Leverage Labor Market Conditions

Today’s trucking labor market conditions often favor drivers. A widespread shortage of qualified CDL holders increases demand and gives drivers more negotiating power. Bringing competitive job offers or pay scales from rival carriers to the conversation shows employers they must stay competitive to retain talent.

In addition, drivers can reference economic factors such as cost-of-living increases and rising fuel prices to frame arguments for compensation adjustments. These realities impact everyday expenses and can support a call for better financial terms.

Prepare for the Conversation

Drivers with 5+ years of experience can earn 18% more, reflecting the value of tenure Like any important discussion, preparation is key when negotiating compensation. Compile recent pay stubs, safety records, and performance evaluations to bring evidence of reliability and success. This documentation shows your value through a measurable lens.

It also helps to rehearse conversations beforehand. Practicing a few script templates tailored for different employer responses—supportive, hesitant, or resistant—can boost confidence and help keep the dialogue productive.

Negotiate More than Pay

Compensation encompasses more than just salary. Drivers should also consider asking for improvements in:

- Health benefits, such as lower premiums or access to a broader provider network

- Schedules that offer more predictable hours or guaranteed home time

- Tuition reimbursement for further training or CDL school

- Equity options or participation in company profit-sharing programs

Exploring these areas can lead to overall better working conditions, even when direct raises are not on the table.

The Role of Unions, Advocacy Groups, and Legislation

Unions in the Trucking Sector Today

Union representation in the trucking industry has been steadily declining in recent decades. As of the most recent data, less than 10% of drivers are unionized (BLS). This shift has reduced collective bargaining power for many drivers, particularly in for-hire and gig-based sectors. However, established unions like the International Brotherhood of Teamsters continue to play a significant role in labor negotiations and advocacy. They have been active in efforts to establish wage floors and fair labor standards for drivers.

Some recent successes include the enforcement of California’s Assembly Bill 5 (AB5), which reclassifies many independent contractors as employees, granting them access to labor rights and protections. This development, driven in part by union pressure and legal action, is setting a precedent that other states and labor groups may follow.

Advocacy and Driver Representation

Beyond unions, several advocacy organizations have emerged to represent the interests of truck drivers. The Owner-Operator Independent Drivers Association (OOIDA) acts as a major voice for small fleet owners and independent drivers, lobbying on issues like hours-of-service regulations, minimum freight rates, and fair treatment in lease agreements.

Groups like Women in Trucking and Black Truckers United work to promote diversity and inclusion within the industry, while also pushing for better working conditions. These organizations engage in public awareness campaigns and policy advocacy to address systemic challenges faced by underrepresented driver groups.

Impact of New Legislation

Legislation at both the state and federal level is increasingly influencing the structure and regulation of the trucking workforce. One major area of policy activity is the redefinition of independent contractor status, as seen in California’s AB5 law. Other states are exploring similar laws to ensure classification aligns more closely with actual working conditions.

At the federal level, agencies such as the U.S. Department of Transportation (USDOT) are paying closer attention to key driver concerns like detention time—the unpaid hours drivers spend waiting at loading docks—and wage theft practices. Regulatory efforts are underway to improve transparency and enforce compensation compliance (USDOT). These initiatives reflect growing awareness of the financial and operational pressures faced by truckers.

Carrier Strategies to Retain Drivers through Compensation

Competitive Pay Structures

To address driver shortages and reduce attrition, many carriers are rethinking how they compensate drivers. A major trend in 2024 is a shift toward hourly pay and guaranteed minimums. These changes reduce uncertainty and promote consistent earnings, appealing particularly to new entrants who may be wary of variable mileage-based pay.

Signing bonuses are also widely used as a short-term tactic to attract drivers. Among large carriers, the average signing bonus in 2024 has reached $5,000. This upfront incentive can significantly enhance the attractiveness of a position, especially in a tight labor market.

Investing in Benefits

Carriers are investing more in benefits packages that align with drivers’ needs. There’s growing recognition of the stress and health challenges drivers face, prompting fleets to offer mental health support and on-site clinics. These services not only improve wellness but also build loyalty.

Another shift is toward personalized, flexible benefits. Rather than one-size-fits-all plans, companies are providing options that allow drivers to select coverage and perks—such as paid time off or health plans—that best fit their individual lifestyles.

Reducing Turnover

Truck drivers in the West and Northeast earn 8%+ above the national average. Despite these efforts, driver turnover remains a significant issue, with some market segments still experiencing rates over 80% (ATA). To combat this, carriers are increasingly leveraging data analytics to customize retention strategies. By analyzing patterns in driver behavior, performance, and preferences, companies can proactively identify at-risk employees and intervene with targeted engagement or support measures.

This data-driven approach allows for more responsive and effective human resource practices, improving long-term retention.

Emerging Trends and the Future of Driver Compensation

Technology and Transparency

The trucking industry is undergoing a shift toward greater transparency, largely driven by advancements in technology. Pay transparency apps and online review platforms are enabling CDL drivers to compare compensation packages, employer reputations, and job expectations before accepting positions. These tools are creating a more competitive labor market where companies are encouraged to offer fair and straightforward pay structures.

In addition to employer transparency, drivers themselves are leveraging personal apps to track their own performance and earnings. These digital tools allow for real-time monitoring of miles driven, hours logged, and pay received, empowering drivers to better understand and advocate for their own compensation.

Flexible Work and Schedule Design

Driver preferences are influencing how companies design routes and schedules. Relay networks—systems in which drivers hand off loads midway, eliminating the need for long-haul, overnight trips—are being introduced to improve work-life balance. This approach shortens time on the road and allows drivers to return home more often.

Regionalized routes are also gaining traction. By keeping drivers within specific geographic areas, these routes reduce time away from home while maintaining productivity. The result is a model that appeals to drivers seeking both financial stability and personal flexibility.

The Future of Gig Trucking

Gig-based trucking platforms such as Uber Freight are reshaping the industry. These platforms offer contract-based hauls that allow for greater autonomy and the ability to choose when and where to work. As a result, they are attracting a growing base of independent contractors.

However, this model also presents challenges. Many drivers express concerns over inconsistent pay and the lack of traditional employment benefits such as health insurance and retirement plans. As gig trucking continues to expand, these issues will likely remain central to industry discussions around fair and sustainable driver compensation.

Resources and Tools for Drivers

Understanding how to advocate for fair compensation and navigate independent contracting requires the right resources. Below are key tools and services that can support drivers in improving their negotiation outcomes and staying informed.

Wage Benchmarking Tools

- GigWorker – Offers breakdowns of average earnings by gig type, location, and experience level.

- Glassdoor and Indeed – Provide compensation data for delivery and rideshare drivers across companies.

- MIT’s Living Wage Calculator – Helps estimate a livable income in specific regions, useful for setting earning goals.

- Gridwise – A driver assistant app that tracks earnings and compares performance to local benchmarks.

Associations Offering Negotiation Training

- Rideshare Drivers United – Offers workshops and online resources focused on wage advocacy and negotiation strategy.

- National Drivers Association – Hosts webinars and publishes materials on independent contractor rights and best practices for contract negotiation.

- Independent Drivers Guild (IDG) – Provides peer-led negotiation training programs and organizes community support for drivers.

Recommended Legal Support for Negotiating Independent Contracts

- Legal Aid at Work – Offers guidance for independent contractors, particularly around employment misclassification and contract disputes.

- Freelancers Union – Connects members with vetted legal professionals experienced in contract negotiation and review.

- LawHelp.org – A national directory of free or low-cost legal services, some of which specialize in labor issues for gig workers.

These resources can help drivers make informed decisions, negotiate more effectively, and protect their rights within the gig economy.

Conclusion

Average sign-on bonuses rose to $7,800 among top carriers, signaling strong competition. The trucking industry is undergoing significant change, presenting both challenges and opportunities for drivers, carriers, and independent operators. Key takeaways include the importance of staying informed about market trends, the value of strong organizational support, and the power of negotiation in setting fair rates and working conditions.

Empowerment in this sector comes from having access to reliable information, being organized—whether through unions, associations, or online communities—and confidently negotiating terms that reflect the true value of labor.

Now is a critical moment to reassess and reshape how work in trucking is structured. By leveraging current labor dynamics, stakeholders can advocate for fairer practices and create sustainable earning models that benefit both individuals and the industry as a whole.

FAQ

What are the highest paying trucking jobs in 2025?

The highest paying trucking jobs in 2025 will likely include specialized roles such as long-haul drivers with endorsements or those working for companies offering enhanced benefits.

How is technology changing trucking?

Technology is increasing transparency in pay structures and enabling drivers to track their performance and earnings through apps, enhancing negotiation po

-

CDL Endorsements: Boost Your Trucking Career

Continue ReadingCDL Endorsements: Boost Your Trucking Career

CDL endorsements explained: what they are and how they can expand your job options. Explore essential CDL endorsements and their impact on trucking careers. Learn how to enhance job opportunities and drive your success.

Introduction

- CDL Basics

- Overview of CDL Endorsements

- Detailed Breakdown of Major CDL Endorsements

- How to Obtain a CDL Endorsement

- Costs of Obtaining and Maintaining Endorsements

- What Employers Are Looking For in 2024–2025

- Future Outlook

- Conclusion

A Commercial Driver’s License (CDL) is a mandatory credential for operating large, heavy, or hazardous material vehicles across the United States. The CDL is organized into several classes based on the type of vehicle and cargo:

- Class A: For operating combination vehicles, such as tractor-trailers.

- Class B: For single vehicles heavier than 26,001 pounds, including buses and delivery trucks.

- Class C: For transporting hazardous materials or more than 16 passengers in smaller vehicles.

In addition to these classes, endorsements are certifications added to a CDL to allow drivers to operate certain types of vehicles or transport specific cargo, such as hazardous materials (H), tank vehicles (N), or passenger transport (P). These endorsements are critical in expanding a driver’s capabilities and meeting employer requirements.

As of 2024, the trucking industry has seen updates in safety protocols, training standards, and digital record-keeping requirements. Regulatory changes focus on improving driver safety and adapting to new transportation technologies. These changes have made it increasingly important for drivers to maintain updated credentials and knowledge.

The industry is also facing a significant driver shortage, particularly in areas requiring specialized endorsements. According to the ATA Report, 2024, the demand for qualified CDL holders—especially those with certifications for hazardous materials or long-haul capabilities—continues to rise. This shortage presents ongoing challenges in freight capacity and delivery timelines, making accurate licensing and endorsements more vital than ever.

CDL Basics

What is a CDL?

A Commercial Driver’s License (CDL) is a special license required to operate large, heavy, or hazardous-materials vehicles in the United States. Issued by state governments, a CDL ensures that drivers are properly trained and qualified to handle more complex driving responsibilities than standard passenger vehicles.

There are three classes of CDLs, each authorizing different types of commercial vehicles:

- Class A: Allows the holder to operate any combination of vehicles with a Gross Combination Weight Rating (GCWR) of 26,001 pounds or more, provided the towed vehicle is more than 10,000 pounds. This includes tractor-trailers and flatbeds.

- Class B: Covers single vehicles with a Gross Vehicle Weight Rating (GVWR) of 26,001 pounds or more or any such vehicle towing another weighing less than 10,000 pounds. Examples include box trucks, large buses, and dump trucks.

- Class C: Applies to vehicles designed to transport 16 or more passengers (including the driver) or carry hazardous materials, regardless of weight.

While the federal government, through the Federal Motor Carrier Safety Administration (FMCSA), sets minimum standards for CDLs, each state administers its own tests, training requirements, and application procedures. States must comply with federal standards, but they may impose additional regulations, making it important for applicants to review their specific state guidelines.

Who Needs a CDL Endorsement?

Hazmat endorsements can boost annual earnings by 8–12% versus non-endorsed drivers In addition to obtaining the appropriate CDL class, certain commercial vehicle operations require specific endorsements. These endorsements represent additional certifications that permit drivers to operate specialized vehicles or transport particular types of cargo.

Common CDL endorsements include:

- H endorsement: Required to transport hazardous materials (HazMat).

- N endorsement: Necessary for driving tank vehicles.

- P endorsement: Needed to operate passenger vehicles.

- S endorsement: Applied for school bus drivers.

- T endorsement: Permits double or triple trailer operation.

Drivers must pass additional knowledge tests—and in some cases, skills tests—to earn these endorsements. For example, HazMat endorsements require a background check by the Transportation Security Administration (TSA).

Enforcement of these requirements is handled at both state and federal levels, with penalties for non-compliance ranging from fines to disqualification of driving privileges. Employers and drivers are both held accountable for ensuring endorsements are current and applicable to the vehicles operated.

Overview of CDL Endorsements

Commercial Driver’s License (CDL) endorsements are special authorizations that allow drivers to operate certain types of commercial vehicles or carry specific cargo. Endorsements are added to a driver’s CDL after passing knowledge and/or skills tests related to the endorsement subject. Below is a list of common endorsements and a summary of how endorsements differ from restrictions.

List of Common Endorsements

- H – Hazardous Materials (HAZMAT)

- Required to transport hazardous materials. Drivers must pass a written test and complete a background check by the Transportation Security Administration (TSA).

- N – Tank Vehicles

- Allows the driver to operate a vehicle designed to transport liquid or gaseous materials in a permanently mounted tank or portable tanks with a capacity of 1,000 gallons or more.

- X – Tank plus Hazardous Materials (Combination of H and N)

- Covers both hazardous materials and tank vehicle endorsements. Drivers must meet all requirements for both H and N endorsements.

- T – Double/Triple Trailers

- Authorizes operation of double or triple trailers. A written knowledge test is required.

- P – Passenger Transport

- Required to operate a vehicle designed to carry 16 or more passengers, including the driver. Both knowledge and skills tests are needed.

- S – School Bus

- Needed to operate a school bus. It requires a background check, knowledge and road test, and possession of a P (Passenger) endorsement.

- M – Motorcycle (in some jurisdictions with commercial classification)

- Permits operation of motorcycles under commercial classification where applicable.

Endorsement vs. Restriction

Endorsements grant additional driving privileges based on experience and testing. In contrast, restrictions limit the driver’s ability to operate certain types of vehicles or equipment.

Key Differences

- Endorsements are optional and expand a driver’s qualifications.

- Restrictions are placed on a CDL when a driver is not qualified to operate a specific type of vehicle or equipment.

Common Restrictions

- L – Air Brakes Restriction: Indicates the driver is not qualified to operate vehicles with air brakes, typically due to not passing the air brake knowledge test or skills test in a vehicle with air brakes.

- E – Automatic Transmission Restriction: Applied when the skills test is taken in a vehicle with an automatic transmission, prohibiting the driver from operating manual transmission commercial vehicles.

- Z – No Full Air Brake System: Restricts the driver from operating vehicles with a full air brake system, often resulting from testing in a vehicle without one.

Detailed Breakdown of Major CDL Endorsements

1. H – Hazardous Materials (HAZMAT)

What It Covers

Pay ranges can reach $90K–$105K for certain trucking roles. The H endorsement allows drivers to transport hazardous materials that are flammable, explosive, or toxic. These include items like fuel, chemicals, gases, and radioactive substances.

Requirements

To obtain this endorsement, applicants must pass a written knowledge test and undergo a Transportation Security Administration (TSA) background check.

Market Demand & Stats

Over 18% of U.S. freight tonnage includes hazardous materials, suggesting strong demand for qualified HAZMAT drivers (PHMSA, 2023). On average, drivers with this endorsement earn 8–12% more annually than their non-endorsed peers (BLS, 2024).

2. N – Tank Vehicles

What It Covers

The N endorsement is required for operating vehicles designed to carry liquid or gaseous materials in permanent or portable tanks with an individual rated capacity of over 1,000 gallons.

Testing & Qualifications

Drivers must pass a specialized knowledge test focusing on the safe operation and handling of tank vehicles.

Industry Insight

Tanker drivers are increasingly sought after, particularly within the fuel and chemical industries, where distribution networks continue to expand (NTTC Analysis, 2024).

3. X – Combination of Tank Vehicle and HAZMAT

Why It’s Critical

The X endorsement combines both H and N endorsements, enabling drivers to haul bulk liquids that are also hazardous. This is especially important in the energy and chemical distribution sectors.

Risk & Compensation

Because of the increased liability and safety responsibilities, drivers with the X endorsement are among the highest-paid in the CDL field. Many earn between $90,000 and $105,000 annually as of 2024 (Indeed Wage Data, 2024).

4. T – Double/Triple Trailers

Description

This endorsement authorizes drivers to operate combination vehicles with two or three trailers.

Requirements

To qualify, applicants must pass a written knowledge test. No additional skills test is required.

Regulation Alerts

The use of triple trailers is restricted or banned in several states. Drivers must check with specific state Departments of Transportation to ensure compliance (FMCSA Guidelines, 2024).

5. P – Passenger Transport

Vehicle Types

The P endorsement covers vehicles designed to transport passengers, including buses, shuttle vans, and tour vehicles.

Testing Process

Applicants are required to complete both a written knowledge test and a behind-the-wheel driving exam. Some states also mandate a background check.

Career Tracks

Job opportunities span transit agencies, charter companies, and intercity transportation. Passenger carrier demand rose 7.9% between 2022 and 2023 (APTA, 2024).

6. S – School Bus

Characteristics

The S endorsement is a specialized subset of the Passenger endorsement, tailored for drivers of school buses.

Unique Requirements

Applicants must complete fingerprinting and criminal background checks, as well as pass rigorous written and road tests focused on student safety and school bus procedures.

Demand

There is a significant shortage of certified school bus drivers across the U.S., with a projected shortfall of 23,000 drivers in 2024 (NSTA, 2024).

How to Obtain a CDL Endorsement

Obtaining a Commercial Driver’s License (CDL) endorsement allows drivers to operate specialized types of commercial vehicles or carry specific cargo. Here is a step-by-step guide to the process:

Step-by-Step Process

- Hold a valid CDL (Class A, B, or C)

Before applying for any endorsement, you must already possess a valid CDL in the appropriate class for the type of vehicle you intend to drive.

- Study your state’s CDL manual and endorsement-specific materials

Each state provides a CDL manual outlining the requirements for various endorsements like HAZMAT, passenger transport (P), or school bus (S). Make sure to review the sections relevant to the endorsement you’re seeking.

- Schedule and pass knowledge or skills exams

Most endorsements require a written (knowledge) test. Some, like the school bus or passenger endorsements, also require a road (skills) test. Schedule your exams at a certified testing center.

- Pass background checks (where required)

Certain endorsements, like the HAZMAT (H) endorsement, require a Transportation Security Administration (TSA) background check. The screening includes fingerprinting and a security threat assessment.

- Fees and re-certification processes

State motor vehicle departments may charge test and application fees. Some endorsements must be re-certified periodically, especially HAZMAT, which includes ongoing TSA screenings.

Testing Tips

- Take official training programs

Enrolling in an FMCSA-approved training program can increase your chances of passing the necessary exams, especially for skill-based endorsements.

- Use online practice exams

Practice tests specific to each endorsement help familiarize you with question formats and common topics.

- Be aware of test center protocols

Arrive with appropriate identification, your current CDL, and any additional documents required for your endorsement exam.

Renewal & Medical Certification

- Endorsements typically renew with your CDL

Most endorsements are extended when you renew your standard CDL, though some may have separate requirements.

- HAZMAT requires periodic TSA screening

Drivers with a HAZMAT endorsement must complete a TSA background check every five years, or as required by state guidelines.

- Maintain medical certification

Under the Federal Motor Carrier Safety Administration (FMCSA) rules, CDL holders—including those with endorsements—must comply with medical certification requirements, including maintaining an up-to-date medical examiner’s certificate (FMCSA, 2023).

Costs of Obtaining and Maintaining Endorsements

Demand is increasing for CDL drivers with specialized endorsements, including Hazmat. Obtaining and keeping endorsements on a commercial driver’s license (CDL) involves several expenses. Initial testing fees vary by state but are typically in the range of $10 to $90 per endorsement. These fees usually cover the cost of written exams required to qualify for specific endorsements like tanker, passenger, or HAZMAT.

For drivers pursuing a HAZMAT endorsement, additional costs include a Transportation Security Administration (TSA) background check. This screening costs $86.50 and must be renewed every five years.

Maintaining endorsements also often requires ongoing training, particularly for endorsements such as HAZMAT and tanker. These types of endorsements are subject to stricter regulatory oversight and safety standards, which necessitate periodic refresher courses or certification renewals.

In some cases, employers may offer or sponsor the required training as part of workforce development programs. This can help reduce out-of-pocket expenses for drivers and ensure that staff remain compliant with federal and state regulations.

What Employers Are Looking For in 2024–2025

Trending Endorsements

As the transportation industry adapts to changing economic demands, employers are prioritizing specific endorsements that reflect current logistical needs. In 2024–2025, the X endorsement has emerged as one of the most in-demand qualifications. This designation enables drivers to operate multiple types of commercial vehicles, making them a flexible asset for fleet operations.

Additionally, school bus and passenger endorsements are seeing renewed growth. A key driver of this demand is local transit stimulus funding, which has revitalized hiring across municipal and educational transportation sectors (DOT Grant Summary, 2024).

Competitive Edge Through Multi-Endorsements

Drivers holding multiple endorsements are increasingly preferred by employers. Combinations such as Hazmat (H), Tanker (N), and Double/Triple Trailers (T) allow for broader route coverage and operational versatility. The ability to assign a single driver across multiple load types reduces overhead and scheduling complexity for carriers.

To retain these multi-skilled professionals, many companies are offering targeted incentives, such as signing bonuses and tiered pay structures, making multi-endorsements a strategic asset for career growth and job security.

Future Outlook

Tanker drivers remain in high demand as fuel and chemical freight continues to expand Looking ahead, the commercial driving industry is set to undergo significant regulatory and technological changes. In 2025, the Federal Motor Carrier Safety Administration (FMCSA) is scheduled to modernize the testing process for specialized endorsements such as hazardous materials and passenger transport. This initiative, listed in the DOT Rulemaking Agenda, 2024, aims to streamline examinations, reduce administrative backlog, and align testing protocols with current industry standards.

Additionally, background checks and license renewal procedures are expected to move further into digital platforms, improving efficiency and accessibility. These digitization efforts are intended to reduce paperwork for drivers and state agencies, and to establish faster turnaround times for processing approvals.

In terms of training, new mandates are being proposed for safety curriculum related to hazardous freight operations. These updates will likely require carriers and training providers to adopt standardized instruction materials and expand practical components to better prepare drivers for real-world scenarios. These steps aim to raise the safety baseline across the industry and address evolving risks in freight logistics.

Conclusion

Obtaining CDL endorsements provides several advantages for commercial drivers. Endorsements like Hazmat (H), Tanker (N), and Doubles/Triples (T) expand the range of vehicles a driver is qualified to operate, potentially leading to increased job opportunities and higher pay. Drivers with specialized endorsements are often more competitive in the job market, especially in sectors with consistent freight demand.

When deciding which endorsements to pursue, drivers should consider their long-term career goals and the specific needs of the trucking industry. Endorsements aligned with high-demand freight sectors can lead to more stable employment and career advancement.

Finally, it’s crucial for drivers to stay informed about changing state and federal transportation regulations. Regulatory updates can affect eligibility requirements and safety standards, making ongoing education a necessary part of maintaining and benefiting from CDL endorsements.

FAQ

What are the highest paying trucking jobs in 2025?

The highest paying trucking jobs in 2025 typically involve specialized endorsements such as Hazmat (H) and Tanker (N), with salaries reaching $90,000 and above.

How is technology changing trucking?

Technology in trucking is evolving with digital record-keeping, streamlined testing processes, and improved safety protocols, enhancing efficiency and driver management.

-

Owner Operators in Trucking: A Comprehensive Guide

Continue ReadingOwner Operators in Trucking: A Comprehensive Guide

Starting as an owner-operator can require $100K+ upfront This article delves into the role of owner operators in the trucking industry, covering essential responsibilities, benefits, challenges, and steps to achieve success.

- Introduction

- Understanding the Role of an Owner Operator

- Step-by-Step Guide to Becoming an Owner Operator

- Owner Operator Financial Planning and Management

- Finding Loads and Choosing the Right Business Model

- Regulatory Changes Affecting Owner Operators (2024–2025)

- Tips for Long-Term Success as an Owner Operator

- Conclusion

Introduction

An owner operator in the U.S. trucking industry is a self-employed commercial truck driver who owns or leases their own vehicle to haul freight. Unlike company drivers, who operate trucks owned by their employer and are typically on a fixed schedule with set routes, owner operators have greater control over their business—choosing their loads, setting their schedules, and negotiating their rates.

The key difference between company drivers and owner operators lies in autonomy and responsibility. Company drivers focus solely on driving, while owner operators also handle maintenance, business expenses, and regulatory compliance. This comes with both benefits and challenges.

Owner operators often earn higher income potential and enjoy greater flexibility and independence. However, they also face risks such as fluctuating fuel costs, maintenance expenses, and the burden of running a business.

In today’s market, the demand for freight transportation has surged due to growth in e-commerce and supply chain needs. This increased demand has made the owner operator model more appealing to experienced drivers seeking financial and professional independence through self-employment.

Understanding the Role of an Owner Operator

Responsibilities

Owner operators are independent truck drivers who own and operate their own commercial vehicles. One of their core responsibilities is owning and maintaining their trucking equipment. This includes not only purchasing a reliable truck and trailer but also keeping them in good condition through regular maintenance, repairs, and upgrades.

They are also responsible for managing their routes, clients, and schedules. Unlike company drivers, owner operators must seek out and negotiate contracts, coordinate pickups and deliveries, and plan efficient routes to maximize profitability and minimize downtime.

Additionally, they handle the business side of operations. This includes preparing invoices, managing billing, tracking expenses, and handling accounting tasks. Many owner operators use accounting software or hire professionals to keep their finances organized and ensure taxes are filed correctly.

Benefits

One major benefit of being an owner operator is the potential for higher income. Since they contract directly with clients or freight brokers, they can often command better rates. There are also several tax advantages available to independent contractors, such as deductions for vehicle expenses, insurance, and depreciation.

Flexibility is another advantage. Owner operators have the freedom to choose their schedules and the routes they want to run. This level of control allows them to balance work with personal life more effectively.

Finally, they have autonomy in business decisions. From which loads to take, to who they work with, to how they operate their business, owner operators make these choices independently.

Challenges

Despite the benefits, there are significant challenges. The startup costs of becoming an owner operator are high. Buying a heavy-duty truck, securing insurance, and setting up a business all require significant capital.

Operating costs such as fuel and maintenance are ongoing expenses that can vary with market conditions. Repairs and downtime can severely impact earnings if not managed properly.

Finally, owner operators must stay up to date with regulatory requirements, including Department of Transportation (DOT) regulations, drug testing, logbooks, and safety compliance. Navigating these responsibilities can be complex and time-consuming, particularly for new operators.

Step-by-Step Guide to Becoming an Owner Operator

1. Gain Experience as a CDL Driver

Used sleeper-cab prices averaged $74,980 in Q1 2024, down 6% YoY. Before becoming an owner operator, it’s essential to build a solid foundation as a commercial driver. Most carriers and insurance providers require at least two years of safe driving experience. This period helps drivers develop operational knowledge, become familiar with various freight types, and learn the nuances of route planning, equipment handling, and federal regulations. Best practices during this stage include maintaining a clean driving record, staying compliant with Hours of Service rules, and gaining exposure to different freight lanes.

2. Create a Business Plan

A sound business plan is the roadmap to success as an owner operator. This should include detailed forecasts of startup and ongoing operational costs such as equipment, insurance, fuel, and maintenance. Identifying your target freight markets—such as reefer, dry van, or flatbed—will help tailor your strategies. According to a 2024 study by DAT Freight & Analytics, average startup costs range from $100,000 to $180,000 depending on the equipment type and geographic region (DAT Freight & Analytics). Allocating budgets for fuel, repairs, and downtime is crucial to staying profitable.

3. Choose a Business Structure

Decide whether to operate as a sole proprietorship, limited liability company (LLC), or corporation. Each comes with different tax implications, levels of personal liability, and registration requirements. An LLC, for example, offers legal protection without the double taxation corporations often face. After selecting a structure, register it with the IRS and obtain an Employer Identification Number (EIN), which is required for tax filing and business banking.

4. Secure a Commercial Driver’s License (CDL)

To legally operate a commercial vehicle, you must earn a CDL Class A license, which allows for driving vehicles with a gross combination weight rating (GCWR) of 26,001 pounds or more. Depending on your freight type, endorsements like Hazmat (H), Tanker (N), or Doubles/Triples (T) might be necessary. Additionally, passing a DOT medical exam and enrolling in a drug and alcohol testing program are required components of CDL eligibility.

5. Purchase or Lease a Truck

Choosing between buying and leasing depends on your financial situation and long-term business goals. Buying a truck provides full ownership and equity but comes with higher upfront costs. Leasing, whether through a carrier program or third party, can reduce initial investment but may include contractual restrictions. In Q1 2024, the average cost of a used sleeper cab was $74,980, representing a 6% decrease year-over-year (American Truck Dealers Association).

6. Get Required Authorities and Permits

To operate legally, you need a USDOT number and a Motor Carrier (MC) number, both issued by the Federal Motor Carrier Safety Administration (FMCSA). Additional requirements include Unified Carrier Registration (UCR), BOC-3 filing (designation of process agents), and apportioned plates through the International Fuel Tax Agreement (IFTA) and International Registration Plan (IRP). The FMCSA reported over 12,000 new motor carrier authorities issued in the first half of 2024 (Federal Motor Carrier Safety Administration).

7. Obtain Trucking Insurance

Adequate insurance is mandatory and protects your truck, cargo, and business. Core policies include primary liability (required by law), cargo insurance, and bobtail insurance when operating without a trailer. Monthly premiums vary but generally range from $800 to $1,800 depending on your driving history, region, and types of freight hauled (Sentry Insurance).

8. Set Up a Compliance & Safety Program

Staying compliant with federal and state regulations is vital. This involves maintaining electronic logging device (ELD) records, logging Hours of Service (HOS), tracking maintenance, and enrolling in a drug and alcohol testing consortium. Regular internal audits and proactive management of your Compliance, Safety, Accountability (CSA) score will help ensure that your operation remains in good standing with regulatory agencies.

Owner Operator Financial Planning and Management

Start-Up Costs Breakdown

Owner-operator insurance premiums often range $800–$1,800 per month (Sentry Insurance data). Starting an owner-operator business requires a substantial initial investment. Major start-up costs include the purchase or lease of the truck, which can range from $50,000 to over $150,000 depending on the model, year, and condition. Leasing options may reduce the upfront expense but often involve long-term financial commitments.

You’ll also need to secure various permits, register your vehicle, and purchase insurance coverage required to operate legally. These administrative costs typically add up to several thousand dollars. Additionally, it’s advisable to set aside an emergency fund and maintain sufficient working capital to cover early operational expenses and unanticipated repairs.

Ongoing Expenses

Fuel is the largest recurring expense for owner-operators, accounting for approximately 28% of total expenses in 2024. Costs can vary widely depending on fuel prices, load weight, and miles driven. Maintenance and repairs are the next major category, generally consuming 10% to 15% of revenue for a well-maintained vehicle—with older trucks often requiring more frequent service.

Insurance premiums, including liability, cargo, and physical damage coverage, are another significant ongoing cost. These premiums must be paid regularly and are subject to periodic renewal, often with adjustments based on claims history and market rates.

Average Revenue and Profit Potential

The median annual gross revenue for solo owner-operators is approximately $205,000 before expenses (Trucker Path Survey). After accounting for costs like fuel, maintenance, insurance, and administrative fees, net income typically ranges from $45,000 to $85,000 per year. Profit margins can vary widely depending on contract terms, preferred freight lanes, and overall efficiency.

Managing Cash Flow

Effective cash flow management is vital. Delays in invoicing and payment can create financial strain, especially when expenses are front-loaded. Some operators use freight factoring services to receive immediate payment on invoices, though these services charge fees that reduce overall revenue.

Load boards can help maintain consistent workflow by connecting operators with available freight, smoothing out income variability. Budgeting tools and bookkeeping software allow for accurate tracking of income and expenses, aiding in financial planning and tax preparation.

Finding Loads and Choosing the Right Business Model

Working Under a Carrier vs. Running Under Own Authority

When starting a trucking business, one of the first decisions to make is whether to operate under a larger carrier or to run under your own authority. Each option has advantages and drawbacks that impact load access, responsibilities, and overall business control.

Working under a carrier means leasing on to an established trucking company. The carrier handles compliance, insurance, and sometimes even fuel cards or maintenance coordination. This option reduces administrative burdens and often grants access to steady freight. However, carriers typically take a percentage of your earnings and limit your autonomy in choosing loads or routes.

Running under your own authority offers independence. You control your business name, loads, contracts, and operations. This allows for higher profit potential but requires more responsibility. You’ll need to handle regulatory compliance, insurance, safety audits, and broker and shipper relationships. Startup costs and time commitments are also higher.

In summary:

- Under a Carrier: Lower overhead, easier startup, less control, revenue split.

- Own Authority: Full control, greater earning potential, higher risk and responsibility.

Logistics and Load Boards

Maintenance and repairs can take 10%–15% of an owner-operator’s revenue (2024) Load boards are a key resource for sourcing freight. These platforms connect carriers with available loads posted by brokers and shippers. Leading load boards include DAT, Truckstop, 123Loadboard, and Convoy. Each board offers tools like credit checks, trip planning, and rate analytics to help carriers make informed decisions.

Carriers must also understand the difference between spot market and contract freight. The spot market is dynamic, with load rates fluctuating based on supply and demand. It’s ideal for flexibility and filling empty miles. However, it can be inconsistent and price-volatile.

Contract freight offers fixed rates and a consistent stream of loads. This model typically requires long-term agreements with shippers or brokers, providing more stability but with less flexibility in scheduling or rates.

Building a Customer Base

To move beyond dependence on load boards and brokers, carriers should focus on building direct relationships with shippers. Effective outreach strategies include cold calling logistics departments, attending industry trade shows, and networking with businesses in your region.

Joining industry directories and databases like Blue Book or Carrier411 can also improve visibility. Additionally, leveraging a mix of freight brokers can serve as a bridge while you develop steady shipper relationships. Over time, direct contracts with shippers can lead to better rates, predictable lanes, and steady income.

Regulatory Changes Affecting Owner Operators (2024–2025)

Revised Hours of Service Rules

Recent updates to the Federal Motor Carrier Safety Administration’s (FMCSA) Hours of Service (HOS) regulations are impacting how owner operators manage their driving schedules. Notably, modifications to the split sleeper berth rule now allow drivers using a sleeper berth to split their 10-hour required rest period into two periods, provided one off-duty period is at least 7 consecutive hours in the sleeper berth, and the other is no less than 3 hours. This change enhances driver flexibility but requires careful time tracking to stay compliant.

In addition, changes to the short-haul exemption have expanded the radius from 100 air miles to 150 air miles and extended the allowable on-duty period from 12 to 14 hours for qualifying drivers. These updates aim to better reflect the realities of regional and short-haul transport while maintaining safety standards.

Clean Truck Initiatives and Emission Regulations

Environmental regulations are tightening at both the federal and state levels. The U.S. Environmental Protection Agency (EPA) continues to roll out Phase 2 of its greenhouse gas (GHG) emissions standards, targeting reductions in CO2 emissions and fuel consumption for medium- and heavy-duty vehicles. These rules especially affect older trucks, potentially rendering some rigs non-compliant or less economical due to higher retrofit or replacement costs.

In California, the Advanced Clean Fleets (ACF) rule mandates that fleets transition to zero-emission vehicles over time. This rule applies not just within California—it has national implications due to California’s waiver under the Clean Air Act and its influence on nationwide manufacturing and compliance standards. Owner operators running in or through California—or those connecting with fleets that must comply—may find themselves needing to upgrade sooner than expected (California Air Resources Board).

Insurance Minimums and FMCSA Rulemaking Updates

There is pending federal legislation that proposes increasing the minimum liability insurance requirement for commercial motor carriers. The proposed changes would raise the current minimum from $750,000 to $2 million or more, citing inflation and increased crash-related costs. While aimed at improving victim compensation and financial responsibility, this increase would impose higher operating costs on small carriers and owner operators.

Separately, the FMCSA continues to review and propose updates to long-standing safety and compliance regulations. Owner operators are advised to monitor the Federal Register for developments that could impact registration, safety audits, or electronic logging device (ELD) requirements.

Tips for Long-Term Success as an Owner Operator

Maintenance and Equipment Strategy

Median gross revenue for solo owner-operators: $205,000 (before expenses) Consistent preventative maintenance is critical for extending the lifespan of your truck and minimizing costly downtime. Scheduling regular oil changes, tire inspections, and system diagnostics can help catch potential issues early. Adopting a maintenance calendar and logging all services improves reliability and resale value.

When it comes to truck replacement, evaluating cost-benefit over time is essential. Older trucks may become increasingly expensive to maintain, while newer models offer better fuel efficiency and compliance with emissions standards. A good rule of thumb is to assess replacement viability every 5 to 7 years, depending on mileage, condition, and repair frequency.

Fuel Efficiency Practices

Reducing fuel costs starts with using tools like fleet fuel cards, which offer savings and track expenses. Route optimization software can help minimize unnecessary detours and improve delivery timing, while reducing idle time preserves fuel and reduces engine wear.

The industry average for Class 8 trucks is roughly 6.5 miles per gallon (MPG), but with the introduction of aerodynamic designs, efficient drivetrains, and advanced telematics, operators can achieve up to 8 MPG or more (U.S. Department of Energy).

Networking and Industry Associations

Joining professional organizations like the Owner-Operator Independent Drivers Association (OOIDA) provides access to advocacy, legal support, and insurance options. Participation in regional trucking groups helps build local connections and create partnerships.

Online forums and load-sharing platforms also allow owner operators to exchange advice, find backhauls, and improve lane coverage. Active engagement in these communities often leads to more consistent work opportunities.

Continuing Education and Trend Monitoring

Remaining informed about freight rate trends, regulatory changes, and new equipment technologies is key to staying competitive. Subscribing to trade publications and attending industry events can help.

Modern tools like Electronic Logging Devices (ELDs), GPS-based mileage tracking, and Transportation Management Systems (TMS) streamline operations and improve compliance. Embracing these technologies increases efficiency and positions owner operators for future success.

Conclusion

Starting out as an owner operator is a challenging but rewarding journey. From securing the right commercial vehicle and navigating financing options to obtaining necessary permits and maintaining compliance, each step requires careful planning and execution. Success in this field hinges on preparation, discipline, and adaptability.

New operators must be ready to manage not only the logistics of freight but also the day-to-day responsibilities of running a business. Staying disciplined with budgeting, maintenance schedules, and regulatory updates is critical. Likewise, the ability to adapt—to new technologies, market changes, or shifts in freight demand—can mean the difference between growth and stagnation.

Looking ahead to 2024 and 2025, the freight landscape presents strong opportunities. Increased e-commerce activity and supply chain diversification are set to drive demand. Those who leverage digital tools for route optimization, load matching, and fleet management will be better positioned to succeed in this evolving environment.

The path to becoming a successful owner operator is not easy, but with the right mindset and tools, it is entirely attainable.

FAQ

What are the highest paying trucking jobs in 2025?

The highest paying trucking jobs in 2025 are expected to be those involving specialized freight such as hazardous materials and oversized loads.

How is technology changing trucking?

Technology is changing trucking through advancements in route optimization, electronic logging devices (ELDs), and telematics for improved fleet management.

-

What Trucking Companies Must Offer to Keep...

Continue ReadingWhat Trucking Companies Must Offer to Keep Drivers in 2026

Retention in 2026 will depend on stronger pay and incentives The U.S. trucking industry faces a significant driver shortage that continues to challenge freight operations across the country. With demand for goods steadily rising, the gap between available drivers and shipping needs has grown wider over the past decade.

According to the American Trucking Associations, the industry was short roughly 80,000 drivers in 2021, and this number is expected to rise if current trends continue. Looking ahead to 2025, the demand for freight capacity is projected to increase substantially, posing even greater pressure on an already strained driver workforce. This will likely make retention efforts even more critical, as competition for qualified drivers intensifies.

Understanding what’s driving this high turnover is essential for developing solutions. Key factors influencing driver retention include industry wages, working conditions, lifestyle demands, and regulatory changes. Each plays a role in shaping how long drivers stay on the job and what it takes to encourage long-term careers in trucking.

- Compensation & Financial Incentives

- Work-Life Balance and Scheduling Improvements

- Equipment Quality and Safety Technology

- Training, Career Development, and Culture

- Health, Wellness & Mental Support

- Modern Communication and Tech Access

- Inclusion, Diversity & Generational Appeal

- Policy, Regulation, and Compliance Alignment

- Conclusion

Compensation & Financial Incentives

Competitive Base Pay

In 2024, the average annual compensation for over-the-road (OTR) CDL drivers reached $69,000, reflecting continued upward pressure on wages due to driver shortages and freight demand [ATA, 2024]. Pay structures vary, with companies adopting different models including mileage-based, hourly, and salaried pay. Transparent communication about these models is key to driver satisfaction, as each format impacts earnings predictability and alignment with work expectations.

Bonuses and Performance-Based Incentives

Sign-on bonuses continue to be a widespread recruitment tool, with 47% of large fleets offering bonuses exceeding $5,000 in 2024 [NPTC, 2024]. However, while effective for attracting new hires, they are often less influential in long-term retention. Companies are increasingly focusing on incentive programs that reward longevity and safe driving. These performance-based incentives better support workforce stability and promote a culture of safety.

Benefits Beyond the Paycheck

Weekly home time is a key reason drivers stay with a carrier Many fleets are enhancing their benefits packages as part of comprehensive compensation strategies. In 2024, there was notable growth in retirement benefits, including wider access to 401(k) plans with improved employer matching. Health-related benefits also saw significant gains: 85% of carriers now offer full health coverage, up from 70% in 2019 [FMSCA Survey, 2024]. Dental and vision insurance offerings are also becoming more standard, contributing to overall driver well-being.

Work-Life Balance and Scheduling Improvements

Predictable and Flexible Schedules

Trucking companies are responding to drivers’ growing demand for more predictable and flexible work schedules. A notable shift has been the increasing preference for regional and dedicated routes, which offer more routine schedules and less time away from home. In fact, regional driving jobs saw a 12% year-over-year increase in 2024 [BLS, 2024]. Additionally, many carriers have begun reducing the number of nights drivers spend away from home each week as a strategic move to improve retention and attract new talent.

Increased Home Time

Offering regular home time has become a standard feature in many carriers’ employment packages. The push toward weekly home-time options is particularly significant, as it aligns with the desires of most long-haul drivers. According to a 2024 survey, 38% of drivers ranked weekly home time as the top reason they choose to stay with a carrier [DriverIQ, 2024]. This indicates how critical home time has become to workforce stability in the trucking industry.

Time-Off Policies

Trucking companies are also enhancing their time-off benefits to support better work-life balance. Paid time off (PTO) and sick leave programs have seen significant growth across the industry. As of 2024, 64% of surveyed carriers provide PTO after just 90 days of employment, a marked increase from 45% in 2021 [NTI Index, 2024]. These improved policies reflect a broader effort to create more sustainable and appealing work environments for drivers.

Equipment Quality and Safety Technology

Modern, Comfortable Trucks